Online Learning for this Generation.

Watch Now.

High School Courses Offered

Students demonstrate motivation to excel in their core courses on the Subject platform.

Teachers report having the tools and support needed to facilitate an effective semester through our platform.

Students demonstrate substantial gains on math exams between the middle and end of our courses.

We create cutting-edge online courses that engage high school students and generate results.

Use of Storytelling

We leverage interactive role-playing and acting out narratives to tap into Gen Z's preference for immersive, social learning experiences.

Watch Now

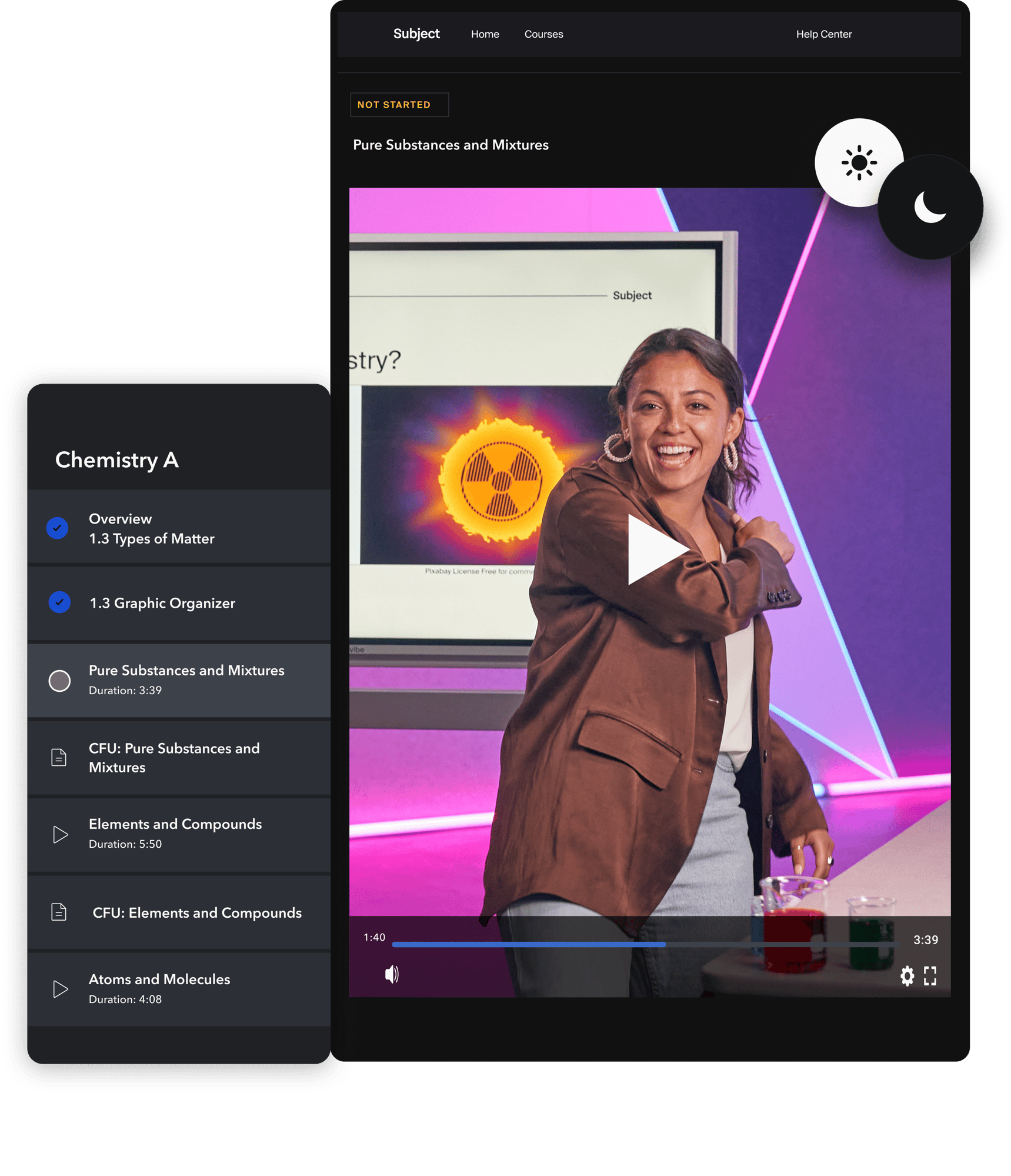

Use of Multimedia

We utilize short video lessons, interactive images, and other multimedia formats to speak to digital natives in their preferred language.

Watch Now

How learning happens for students today.

As students spend 3-4 hours each day online, their preference for bite-sized bursts of information naturally emerges.

Our instructional method includes breaking down important concepts into small, focused segments, linking lessons to familiar cultural examples to promote long-term understanding. This innovative approach encourages thorough engagement and comprehension.

Core curriculum courses for high school students.

Credit Recovery courses for high school students.

Advanced Placement courses for high school students.

Multilingual (Spanish) courses for high school students.

-

It's just the ability for [Subject] to take the interests and the needs of our community and build a platform that's going to serve our students. And working with [Subject's] team and [Brawley's] team and putting together a plan that would be conducive to the needs of our students...we've been hooked from that moment on.

Simon Canalez

Superintendent, Brawley Union High School District -

Subject has profoundly impacted our students at Colton Joint Unified, fostering their growth, engagement and overall academic success.

Dr. Eric Mooney

Director of Secondary Education, Colton Joint Unified School District -

As an independent study high school teacher, it is challenging to find curriculum for students that is engaging, meaningful, and that they can do on their own. My students report that [Subject] is user friendly and that they actually enjoy it! The content sparks great discussions during our weekly appointments and the students seem to be learning and growing from the experience.

Wendy Roscoe

Teacher, Gateway Unified School District -

I had a single class in [previous provider] last year and couldn’t do it. A couple of assignments in and I get so bored I have to stop. With Subject, I’ve already completed 5 courses this semester. I took French for fun. I kid you not this is the best thing I’ve ever used. The UI is great, it’s easy to use, it has a great reward mechanism. I’m so thankful.

Student

Gonzales Unified School District -

Subject is much more engaging than what students were doing prior. The curriculum is well-designed for student learning experiences!

Jaime Lambert

Assistant Principal, Innovation High School/Assurance Learning Academy -

[Other platforms] are stuck in the old times and extremely boring. People really hated it. The videos were too long and the platform was hard to use and not intuitive. Subject feels way more modern.

Student

iLead Exploration

%201.png?width=199&height=55&name=954-9544797_wasc-accreditation-logo-geoffrey-zakarian%20(1)%201.png)